Marketplace Outlook: Within the week ended July 11, the Indian inventory markets had been below drive to promote for the second one consecutive week. The Nifty and Sensex declined by means of greater than 1%. The primary reason why for this used to be international industry pressure, the beginning of the susceptible result of the June quarter and the Indo-US industry deal used to be behind schedule.

Overseas buyers persisted promoting, which weakened the sentiment out there. On the other hand, common purchases of home institutional buyers (DIS), excellent monsoon, reducing rates of interest and coffee inflation supported the marketplace to some degree.

Siddharth Khemka, head of study in Motilal Oswal Monetary Services and products, stated that uncertainty associated with industry deal can stay the marketplace in consolidation mode. Buyers will now track CPI and WPI inflation knowledge, Q1 effects and Indo-US industry deal.

On the identical time, in step with Vinod Nair, analysis head in Geojit Monetary Services and products, buyers will stay a watch intently at the margin steering and sectorial traits, particularly right through the Q1Fy26 effects. Those issue can make stronger the sentiment out there.

Let’s find out about the ones 10 necessary issue, which can make a decision the route and situation of the inventory marketplace within the coming week.

Quarterly result of corporations

The float of company effects can be quicker subsequent week. Ultimate week, some corporations launched quarterly effects, however now greater than 125 corporations will provide their profits stories. Those come with many Nifty-50 mythical corporations, whose general weightage at the index is greater than 32%. Those come with Reliance Industries, HDFC Financial institution, ICICI Financial institution, Axis Financial institution, HCL Applied sciences, HDFC Lifestyles, Tech Mahindra, Geo Monetary Services and products, Vipro JSW Metal.

Additionally, Ola Electrical Mobility, Tata Applied sciences, Angel One, Polycab India, Tata Communications, Bandhan Financial institution, L&T Finance and India Cements will even provide their effects subsequent week. New indexed corporations corresponding to imaginable metal tubes, HDB monetary services and products and Kalpataru will even claim the result of the June quarter.

Ultimate week, the Tata Consultancy Services and products (TCS) began the incomes season with a susceptible quarterly effects, making the marketplace temper a little bit wary.

Impact of trump tariff

The marketplace will have a look at the brand new tariff bulletins of US President Donald Trump on the international stage. Ultimate week, he introduced a charge on a number of industry companions, which has greater vigilance within the world enterprise setting. The prolong within the Indo-US industry deal has additionally created fear out there. Many assets anticipated {that a} mini industry deal can be performed sooner than July 9, however it didn’t occur.

Ultimate week, Trump introduced that 30% new price lists can be applied on imported items from Mexico and Ecu Union from 1 August. The cause of the failure of the negotiations at the back of this used to be given. Trump has additionally warned that if the 2 international locations retaliate, the tariff can also be greater additional. It’s price noting that the percentage of those two international locations is on the subject of one-third of the full imports of The united states.

Previous, Trump introduced a 35% tariff on imports from Canada and 50% on Brazil. Excluding this, he additionally indicated to extend the present 10% tariff to 15-20%, making buyers and alert.

US inflation knowledge

Subsequent week, the marketplace will eye on inflation knowledge coming from The united states. In June, america inflation price could also be reasonably upper than the two.4% of Might. Trump has not too long ago indicated that the tariff -based inflation in america may just build up the price lists on a number of main buying and selling companions and the ultimate assembly of the Federal Open Marketplace Committee (FOMC).

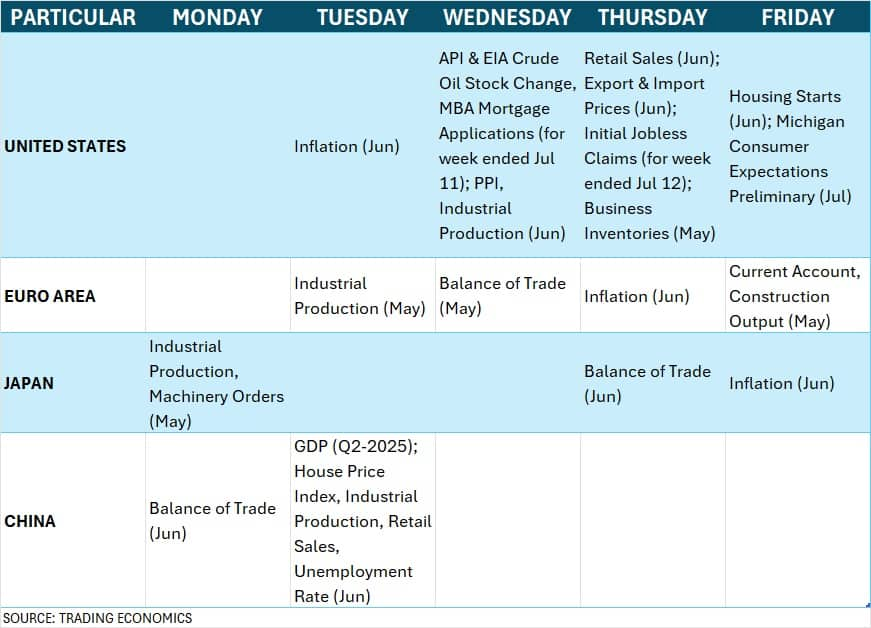

Excluding this, buyers will even control manufacturer Worth Index (PPI), retail gross sales and weekly activity knowledge from america.

International financial figures

Excluding business-related actions and US inflation, China’s April-June quarter may also be monitored on GDP, retail gross sales and unemployment charges. Professionals imagine that this time China’s GDP price could also be reasonably less than 5.4% of the former quarter.

In conjunction with this, Japan and Euro zone will even divulge inflation figures of June, which will have an effect on the marketplace perception on international financial traits.

Home financial figures

The Indian markets can be eyeing the figures of retail and wholesale inflation (WPI) for the month of June, that are to be declared on 14 july. Economists estimate that retail inflation would possibly fall to round 2.5–2.7%, which used to be 2.82% in Might. If this occurs, it’ll be the 8th consecutive month when retail inflation has declined. On the other hand, there could also be some build up in wholesale inflation for June, which used to be 0.39% in Might.

Excluding those, on July 15, the trades of industry steadiness and passenger automobiles for the month of June may also be launched. On the identical time, knowledge of financial institution mortgage and deposit enlargement (as much as fortnight on July 4) and foreign currency echange reserves (until the week finish on July 11) can be launched on July 18.

Subsequent week too, the actions of international institutional buyers (FIIS) will play the most important position in figuring out the route of the marketplace. On the other hand, the marketplace has been getting the fortify of sturdy purchases of home institutional buyers (DIIs). In the second one week of July, Fiis used to be a internet vendor and bought for ₹ 4,511 crore. Prime valuation out there is thought to be the primary reason why for this, because of which Fiis are moving against affordable markets.

In the meantime, america buck index overcrowded from a 40 -month low and climbed 0.91% to near at 97.87. This used to be a leap in protected haven call for because of the uncertainty produced by means of the tariff announcement of Trump. Against this, the Indian rupee closed right down to 85.7750, declining in opposition to america buck and declining 0.38%.

IPO marketplace situation

The velocity of the main marketplace could also be reasonably gradual subsequent week. Right through this time 3 new public problems can be opened, one among which is of the mainboard and the remainder two of the SME section. The mainboard IPO of ₹ 3,395 crore of Anthem Biosciences will open for subscription from 14 to 16 July. On the identical time, Spunweb Nonwoven’s ₹ 61 crore IPO will open on July 14 within the SME section. Monika Alcobev’s ₹ 165.6 crore sme IPO will open from July 16. Each the problems can be closed this week.

Excluding this, the ₹ 583 crore IPO of Smartworks Covorking Areas can be closed on July 14. It has won 1.15 occasions subscription to this point.

Speaking in regards to the record entrance, the Trip Meals Services and products will debut within the inventory marketplace on July 14. This can be adopted by means of Smartworks COWORKING Areas on 17 July. On the identical time, the record of Smarten Energy Programs and Chemkart India within the SME section can be on 14 july. Glen Industries will input the marketplace on 15 July and Assston Prescription drugs on 16 July.

Technical view

Technically, the marketplace appears susceptible, because the Nifty 50 has damaged the midline of 10 and 20-day shifting averages (EMA) in addition to the midline of the Bollinger Bands. Excluding this, weak point could also be being noticed in Momentum Signs. Due to this fact, professionals imagine that so long as the Nifty stays beneath 25,300, the spherical of consolidation can proceed subsequent week.

Now the sight can be at the zone of 24,900–24,800, which is a low of 10-week EMA and the former giant bullish candle. If this stage breaks, the marketing out there would possibly accentuate and the index can cross as much as 24,700. However, if the Nifty remains above 25,300, then a brand new rapid would possibly start.

In keeping with a weekly choice knowledge, the craze of Nifty 50 can also be between 24,800 to twenty-five,300 within the close to long run, whilst the huge scope is noticed from 24,500 to 2500.

Name facet: Probably the most open hobby used to be noticed on a strike of 25,500, adopted by means of 26,000 and 25,300. The perfect name writing is at 25,300, adopted by means of 25,200 and 26,000.

Put facet: Probably the most open hobby used to be at 25,000, adopted by means of 25,200 and 24,500. The perfect put writing is at 25,000, adopted by means of 24,800 and 25,200.

The index that describes the “worry” of the marketplace of India Vix has fallen within the fourth consecutive week. It closed at 11.82, the bottom stage since April 2024. Ultimate week, it has fallen by means of 4.04%, indicating steadiness out there and coffee volatility.

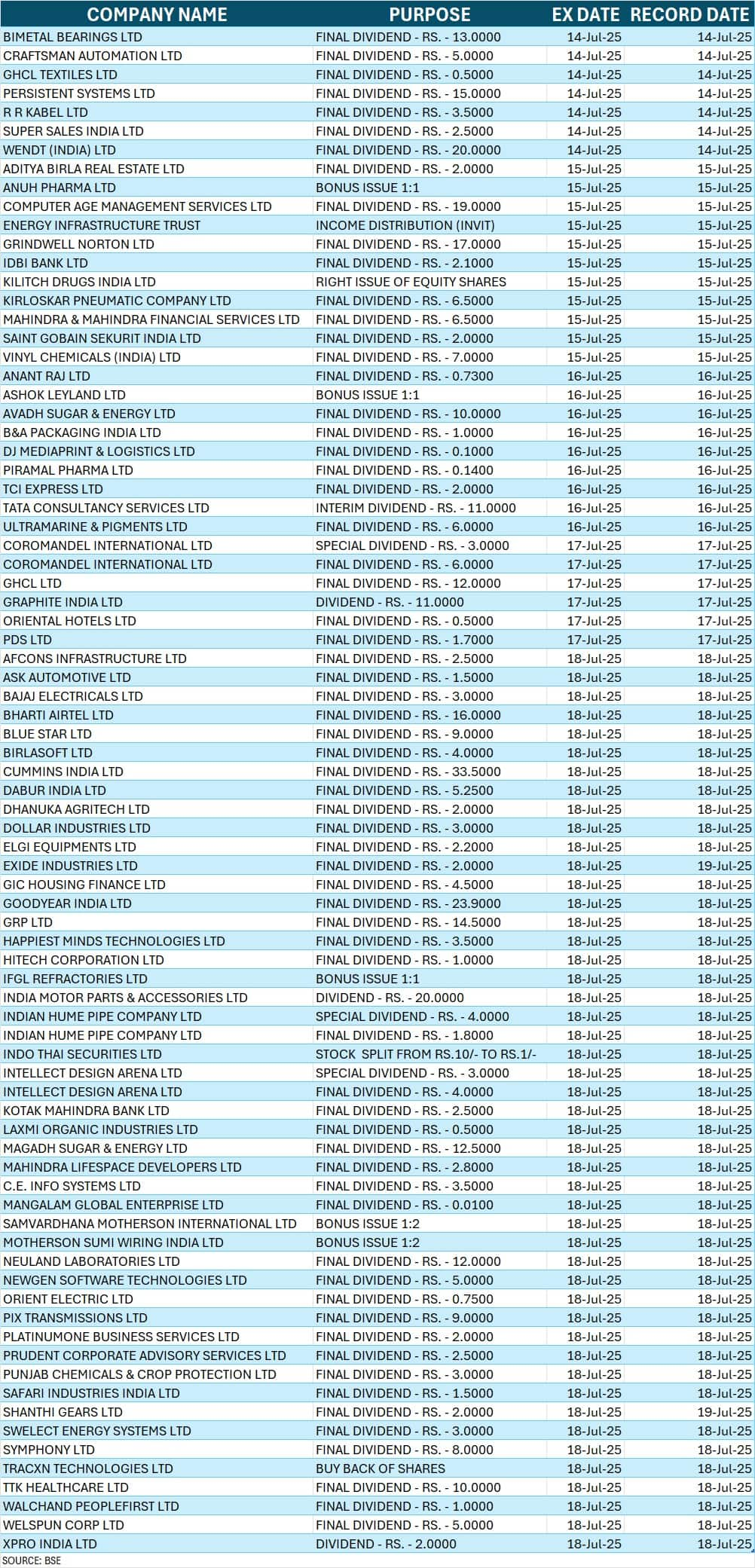

Company motion

Many corporations to be held subsequent week will display company motion. (See chart)

Additionally learn: Nifty Industry Setup: How will the Nifty transfer on July 14, will the trump tariff be surprised?

Disclaimer: Recommendation or thought professionals/brokerage corporations given on Moneycontrol.com have their very own non-public perspectives. The site or control isn’t accountable for this. Moneycontrol advises to customers that all the time search the recommendation of qualified professionals sooner than taking any funding resolution.