Brodder index carried out higher than benchmarks with a acquire of one–1.5 consistent with cent within the industry maintain america, steady promoting of overseas institutional traders, steady promoting of overseas institutional traders, higher home macro information and higher monsoon than standard monsoon than standard monsoon. The bigger-cap index persisted to say no for the 3rd consecutive week and fell 0.5 p.c. Alternatively, the mid-cap and small-cap signs won 1 consistent with cent and 1.5 consistent with cent, overtaking the former week’s decline.

This week, the BSE Sensex fell at 81,757.73 at 81,757.73 and the Nifty closed at 24,968.40 at 81,757.73 and the Nifty closed at 24,968.40 this week. Alternatively, the Sensex and Nifty have fallen by means of 2–2 p.c this month.

International institutional traders (FIIs) persisted promoting even within the 3rd week and offered fairness price Rs 6671.57 crore. Alternatively, home institutional traders (DIIs) persisted their purchases within the thirteenth week and acquired fairness price Rs 9,490.54 crore.

On this month, FII has to this point offered fairness price Rs 16,955.75 crore, whilst DII has purchased fairness of Rs 21,893.52 crore.

Speaking about sectoral index, the BSE Financial institution index declined by means of 1.3 p.c, BSE IT index 1.2 p.c, BSE Capital Items Index declined by means of 1 p.c. However, BSE Realty Index won 3.7 p.c and BSE Auto Index won 1.7 p.c.

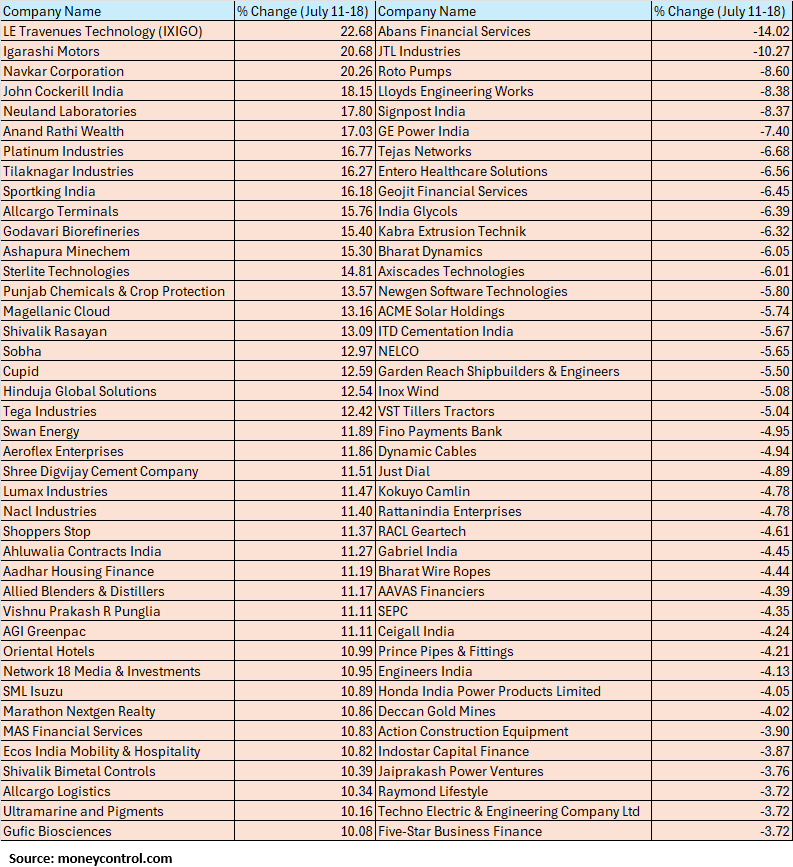

The BSE Smallcap Index rose by means of 1.5 p.c, with LE Travenus Era (IXIGO), Egarashi Motors, Navkar Company, John Cockerrl India, Neuland Laboratories, Anand Rathi Wealth, Platinum Industries, Tilaknagar Industries, Sportskling India, Obsporting India, Obsorteching India Phrases, Observatory, The stocks of Ashapura Minkem rose by means of 15-22 p.c.

How can marketplace transfer forward

Amol Athawale of Kotak Securities Says that final week, benchmark index has noticed income on the higher ranges. At the weekly chart, it has created a recession candle, which could be very unfavourable. The marketplace’s quick time period development is susceptible. However new promoting is conceivable simplest after going underneath 24,900/81600 ranges. Underneath this degree, the marketplace can re-touch the extent of 24,600-24,500/80700-80400.

However, a 50-day SMA (easy shifting moderate) or 25,050/82100 and 25,100/82300 degree will function a very powerful resistance zone for brief investors. If the marketplace is a hit in buying and selling above 25,100/82300, it could jump again to 20-Day SMA or 25,320/83000. Additional, the indexes too can cross as much as 25,450-25,500/83400-83600.

For financial institution Nifty, 50-Day SMA or 56,000 will function a very powerful fortify zone, whilst 20-Day SMA or 56,900 can function a very powerful resistance zone for shocking. Going underneath 56,900, financial institution Nifty can fall to 56,500-56,150, whilst above 56,900, it could cross as much as 57,365-57,600.

The Nifty remained underneath promoting drive and fell to a degree of 24,900. It were given preliminary fortify at this degree. Nifty 50-Day Revel in Shifting Moderate (50EMA) Stayed above and after a quick taxation, the quick time period seems able for the decline. Alternatively, so long as it’s buying and selling underneath 25,260, the tactic of ‘promoting’ will paintings. If the Nifty is going underneath 24,900 on the backside, the marketing would possibly build up.

Disclaimer: The guidelines given on Moneycontrol.com have their very own private perspectives. The web site or control isn’t chargeable for this. Cash regulate advises customers to hunt the recommendation of ST sooner than taking any funding choice.