Marketplace Outlook: The former buying and selling week closed within the inventory marketplace in purple mark. This was once the 3rd consecutive week when the marketplace confirmed weak spot. NIFTY 50 psychologists fell beneath 25,000 issues within the week ended July 18. This decline was once observed because of a susceptible get started of the June quarter effects and uncertainty associated with price lists. On Monday, the marketplace will first react to the result of Index Heavyweights like Reliance Industries, ICICI Financial institution and HDFC Financial institution, which have been launched after the Friday marketplace was once closed and on Saturday.

Siddharth Khemka, head of analysis and wealth control in Motilal Oswal Monetary Products and services, believes that the marketplace will lately stay in consolidation mode given uncertainty in world business and the slow get started of Q1Fy26 effects.

On the similar time, consistent with Vinod Nair, analysis head of Geojit Investments, if a favorable answer is located from the proposed US-India Mini Business Settlement, it could actually support the outlook of export-based sectors. He additionally added that sturdy incomes expansion is important to justify India’s prime valuation.

Let’s learn about the ones 10 vital elements, which is able to make a decision the course and situation of the inventory marketplace within the trade beginning on Monday, 18 July.

June quarter effects

The season of the June quarter effects ranging from July 21 will likely be at complete velocity. A complete of 286 corporations will claim their monetary effects all over this era. Those come with 12 corporations of Nifty 50- Infosys, Kotak Mahindra Financial institution, Bajaj Finance, Ultratech Cement, Everlasting, Dr Reddys Laboratories, Tata Client Merchandise, Nestle India, Sbi Lifestyles Corporate, Bajajaji Finserv, Cipla and Shriram Finance.

Excluding this, Financial institution of Baroda, Canara Financial institution, ACC, One 97 Communications (Paytm), Colgate Palmolive, Dixon Applied sciences, United Breweries, Zee Leisure Enterprises, Bajaj Housing Finance Finance Finance Finana Balkrishna Industries, IDFC First Financial institution and Premier Energies will even lead to effects.

Impact of trump tariff

Globally, traders of various asset categories will likely be eyeing the next step of Donald Trump management, as there may be not up to two weeks left within the August 1 cut-off date. It’s believed that this would be the closing cut-off date extension. After this, the tariff fee will likely be carried out on trade companions.

World professionals consider that this tariff-based uncertainty would possibly additional keep away from america Federal Reserve. The potential of cuts within the July coverage assembly is rather low, whilst the opportunity of cuts of 25 foundation issues in September has additionally come down to simply 50%.

Federal chairman speech

The impending week will stay quite calm on the subject of information, however the marketplace will likely be eyeing the speech of Fed Chair Zerome Powell on 22 July. This speech is regarded as to be vital from the viewpoint of giving course to the way forward for rates of interest, particularly ahead of the FOMC assembly to be held within the closing week of July.

Thus far lots of the Federal Reserve officers have indicated that the remainder a part of 2025 is imaginable to chop Fed Finances Price. Alternatively, he has additionally described the uncertainty associated with trade and coverage and his affect on inflation may be crucial.

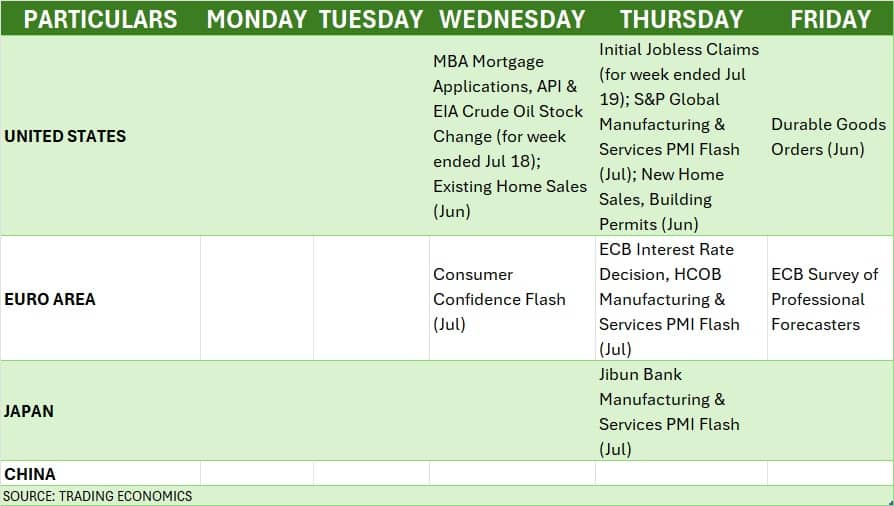

World Financial Knowledge

The verdict at the rate of interest of the Eu Central Financial institution (ECB) goes to be hung on July 24, which will likely be sight of the marketplace. Coverage makers can most likely stay rates of interest strong at 2 % and need to watch for the tariff resolution of Trump, handiest then the charges can also be prone to trade.

Excluding ECB, the marketplace can also be eyeing the flash figures of producing and products and services PMI launched via many nations. In conjunction with this, traders can also be monitored on america weekly jobs information.

Subsequent week, the actions of international institutional traders (FIIS) can also be intently monitored. Remaining week, FIIS extracted ₹ 6,672 crore from the money phase. Because of this, the overall withdrawal has reached round ₹ 17,000 crore up to now in July. The analyst believes that this withdrawal is occurring because of prime valuation, susceptible income and world tariff uncertainty, particularly when there was once a continual internet boying within the closing 3 months.

If truth be told, FIIS has a continual brief place in index futures from June 30, which displays the spirit of recession available in the market. Conversely, home institutional traders (DIIs) compensated the withdrawal of FIS. He has bought ₹ 9,491 crore within the money phase closing week and ₹ 21,894 crore up to now within the month of July.

In the meantime, america Greenback Index witnessed the second one consecutive week of purchases and closed 0.61 % to near at 98.46. It remained within the 20-day and 50-day EMA vary.

Home Financial Knowledge

The infrastructure output figures for the month of June at the home entrance will likely be launched on July 21. After this, on July 24, the flash figures of the Production and Products and services PMI of July will likely be published. In Would possibly, those figures had been 57.6 and 58.8 respectively, which higher to 58.4 and 60.4 in June.

As well as, information of foreign currency reserves will likely be launched on 25 July. Within the week ended July 11, the reserves had come all the way down to $ 696.670 billion, which was once $ 699.740 billion closing week.

IPO marketplace situation

The motion in the principle marketplace goes to be rapid subsequent week, as a complete of eleven new IPOs are going to land at the Side road. Of those, 6 will likely be from SME phase and 1 from Reit phase. The ₹ 473 crore IPO of Propshare Titania will open on July 21. That is the second one scheme of assets percentage funding consider Reit.

Within the mainboard phase, INDIQOBE Areas’ ₹ 700 crore IPO and laptop-decatop refurbishing corporate GNG Electronics will open the primary factor of ₹ 460.4 crore on July 23. The ₹ 759.6 crore IPO of Lodge Chen Brigade Lodge Ventures will open on July 24. On the similar time, the IPO of gold jewelery producer Shanti Gold World will likely be introduced on 25 July.

Within the SME phase, IPOs of Savy Infra & Logistics and Swastika Castal will open on July 21. The general public factor of Monarch Surveyors & Engineering Experts will open from July 22, adopted via TSC India’s ₹ 25.9 crore IPO on 23 July. IPOs of Patel Chem Specialities and Sellowrap Industries will open on July 25 for subscription.

At the checklist entrance, the mainboard corporate Anthem Biosciences will debut at the inventory alternate on 21 July. The checklist of Spunweb Nonwoven and Monika Alcobev of the SME phase will likely be hung on 21 and 23 July respectively.

Technical perspective

From the technical viewpoint, the marketplace’s non permanent development is observed moving into prefer of traits, because the index is buying and selling below 20-day EMA and reached 50-day EMA (24,900) closing week. On Friday, the index broke the make stronger trendline going upwards with a quantity above reasonable.

Momentum signs also are susceptible and feature fallen to RSI 43.07. In keeping with professionals, if the Nifty 50s wreck the extent of 24,900 in a novel manner, the index can cross as much as 24,800–24,500 zones. Alternatively, if this stage is defended or the index surrounding it, then there is also a chance of regularly restoration against 24,200–24,300.

F&O phase situation

In keeping with a weekly choices information, the Nifty 50 is anticipated to stay inside a much broader scope of 24,500 to twenty-five,500, whilst the close to -term vary can also be between 24,800 and 25,300.

The best open hobby at the name choice aspect was once observed on a strike of 25,200, adopted via 25,100 and 25,500. Name writing took place basically on 25,100 moves, then a stir at 25,000 and 25,200 moves.

Speaking in regards to the put choice, the best open hobby was once on 24,900 moves, adopted via 25,000 and 24,500 moves. The best put writing was once additionally on 24,900 moves, adopted via task at 24,950 and 25,000 stripes.

In the meantime, India VIX way ‘Concern Index’ remained in a susceptible box and closed at 11.39 ranges. That is the bottom ultimate stage after April 2024. It remained within the 5th consecutive week decline, which displays steadiness and self belief available in the market. It might additionally warns a imaginable breakout or breakdown.

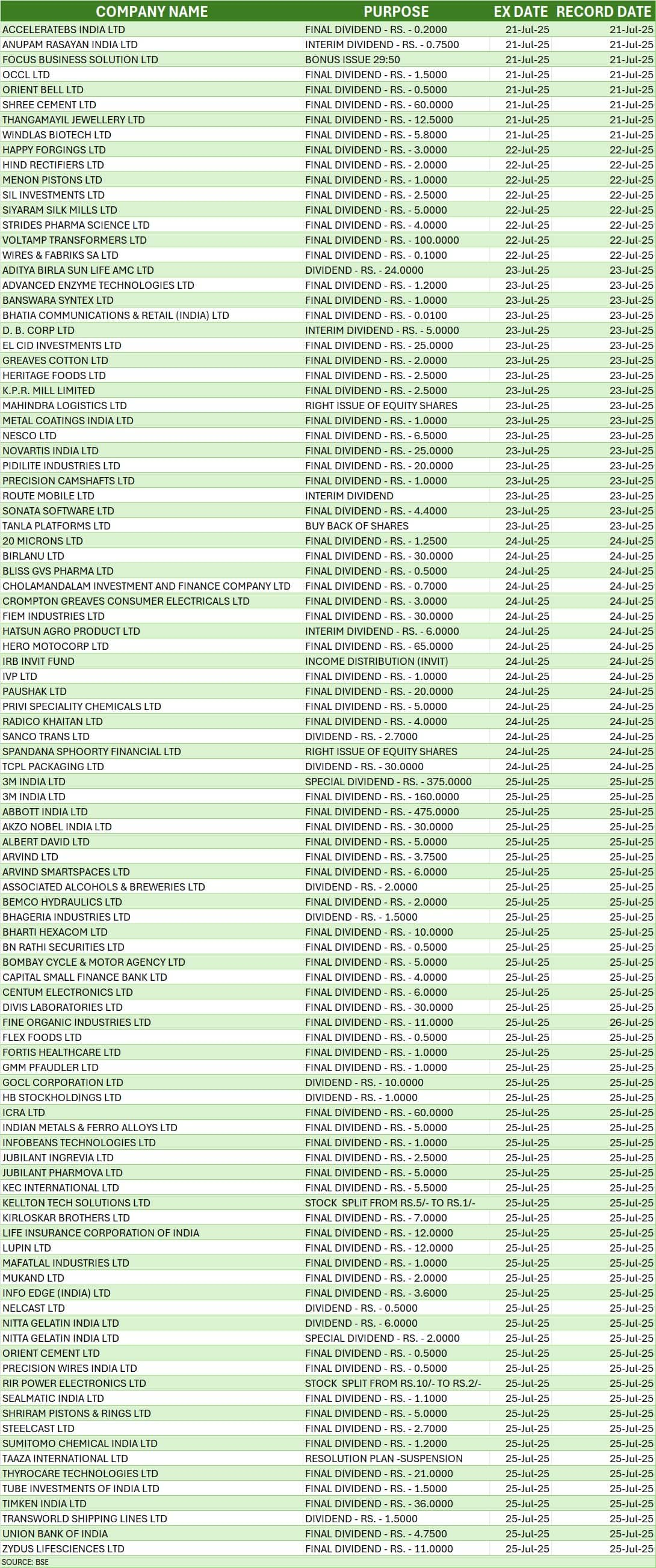

Company motion

Many corporations to be held subsequent week are going to have company motion like dividend and bonus factor. (See chart)

Additionally learn: Vedanta vs Viceroy Analysis: American brief dealer’s new conflict on Vedanta, instructed semiconductor unit ‘Shell Buying and selling Operation’

Disclaimer: Recommendation or thought professionals/brokerage companies given on Moneycontrol.com have their very own private perspectives. The web site or control isn’t liable for this. Moneycontrol advises to customers that all the time search the recommendation of qualified professionals ahead of taking any funding resolution.