Marketplace Business setup : Nifty broke the method of decline of 2 days and began a just right get started on July 21 with a acquire of 0.50 according to cent. On the other hand, the index continues to be buying and selling underneath the non permanent shifting averages (10-Day and 20-Day EMA) and the order of the decrease top-loar backside continues. Till the Nifty regains the resistance zone of 25,200-25,250, it may possibly proceed to industry in a restricted vary with fortify at 24,900. The index can fall to 24,700 when going underneath this fortify. Mavens additionally imagine that if the Nifty is going above the resistance zone, it’ll be essential to keep watch over 25,400.

Right here you’re giving some such figures at the foundation of which it is possible for you to to catch winning offers.

Enhance and registration degree for nifty

Enhance in response to Pivot Level: 24,941, 24,887 and 24,799

Registration in response to Pivot Level: 25,116, 25,170 and 25,257

Financial institution nifty

Registration in response to pivot issues: 57,009, 57,180 and 57,458

Enhance in response to pivot issues: 56,453, 56,281 and 56,003

Registration in response to Fibonacci Retress: 57,050, 57,566

Fibonacci Retress based totally fortify: 56,389, 56,096

Nifty name choice information

A most name of 79.19 lakh contracts has been noticed open pastime on a strike of 25,500 at the per 30 days foundation, which is able to paintings as crucial registration degree within the upcoming industry periods.

Nifty put choice information

A most of 79.67 lakh contracts had been noticed open pastime on a strike of 25,000, which is able to paintings as essential fortify degree within the coming industry periods.

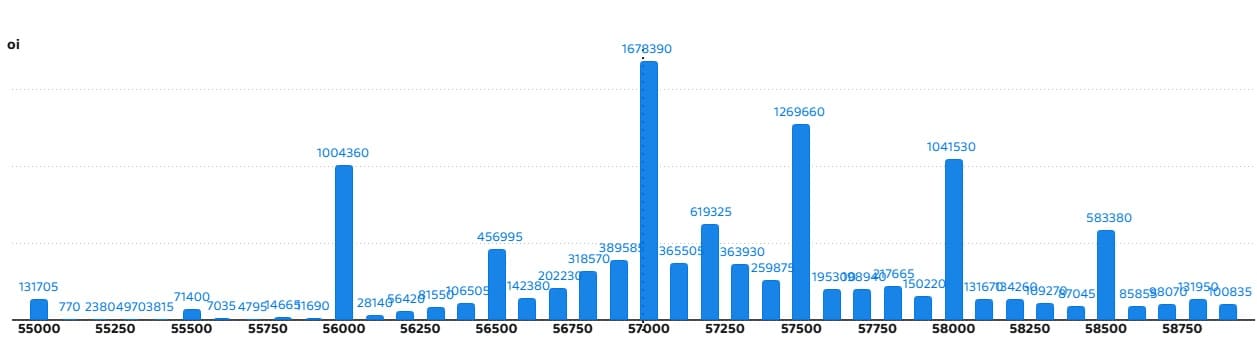

Financial institution Nifty Name Possibility Knowledge

Financial institution Nifty has noticed a most name open pastime of 16.78 lakh contracts on a strike of 57,000, which is able to paintings as essential registration ranges within the coming industry periods.

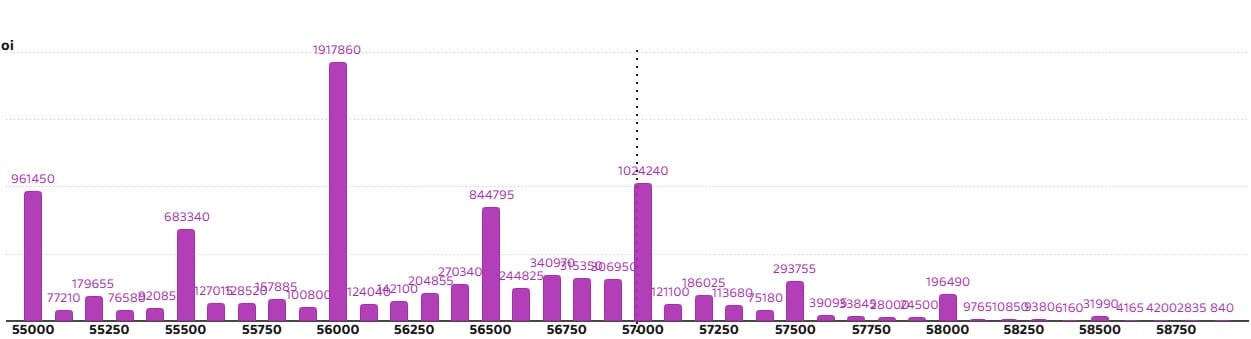

Financial institution Nifty put choice information

On a strike of 56,000, a most put of nineteen.17 lakh contracts has been noticed open pastime which is able to paintings as essential registration ranges within the coming industry periods forward.

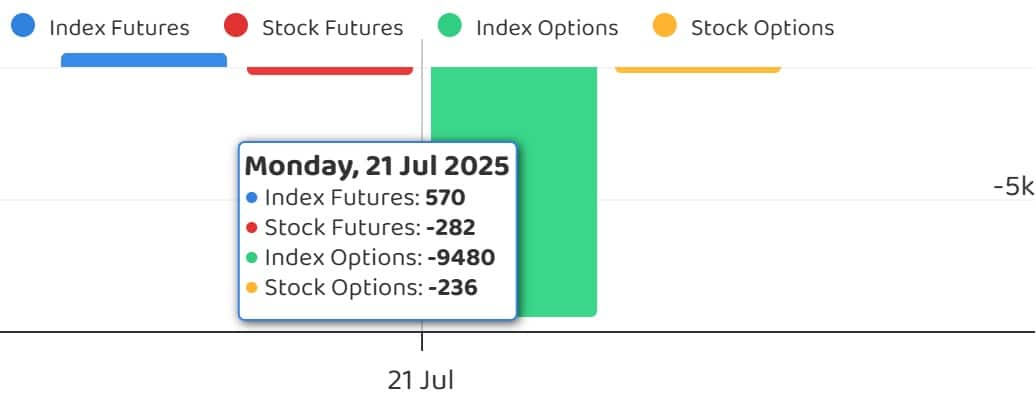

FII and DII Fund Go with the flow

India VIX measuring the marketplace’s imaginable volatility remained at a decrease degree and fell 1.67 according to cent to 11.20. This can be a signal of marketplace steadiness. However buyers must be wary about marketplace fluctuations, as a result of volatility might build up swiftly.

Prime supply industry

Listed below are the shares given through which the most important a part of the supply industry used to be noticed. The huge a part of supply displays the pastime of traders (in contrast to buying and selling) in inventory.

Lengthy build-ups proven in 54 shares

In conjunction with the rise in open pastime, the upward thrust in costs could also be most often estimated to develop into an extended place. Lengthy build-ups have been noticed in 54 stocks at the earlier industry day in response to Open Hobby Long run Share.

Lengthy Unwinding noticed in 33 Shares

In conjunction with the autumn in open pastime, the autumn in costs could also be most often gauged by means of lengthy war of words. In accordance with the Open Hobby Long run Share, 33 stocks noticed the absolute best lengthy lengthy lengthy -liveding in 33 stocks.

Quick build-up proven in 45 shares

In conjunction with the rise in open pastime, the decline in costs could also be most often gauged by means of quick build-up. In accordance with the Open Hobby Long run Share, 45 stocks have been noticed to have the absolute best quick build-up.

Quick protecting in 94 shares

Quick protecting is most often estimated by means of the upward thrust in open pastime in addition to the upward thrust in costs. In accordance with the Open Hobby Long run Share, 94 stocks noticed the absolute best quick protecting in 94 stocks.

Name name ratio

The Nifty Put-Name Ratio, which depicted the marketplace temper, rose to 0.96 on July 21, whilst it used to be at 0.78 ranges within the earlier consultation. Considerably, the departure of PCR above 0.7 or 1 pass PCR is in most cases thought to be an indication of growth. While the ratio falling underneath 0.7 or 0.5 is an indication of recession.

Inventory below F&O Bain

The F&O section comprises the limited securities that come with the by-product contract marketplace broad place prohibit to greater than 95 according to cent.

Shares fascinated with F&O ban: no one

Shares already fascinated with F&O ban: Bandhan Financial institution, RBL Financial institution

Shares got rid of from F&O ban: Angel One, Hindustan Copper

Disclaimer: The information given on Moneycontrol.com have their very own private perspectives. The web page or control isn’t chargeable for this. Cash keep an eye on advises customers to hunt the recommendation of qualified mavens earlier than taking any funding determination.