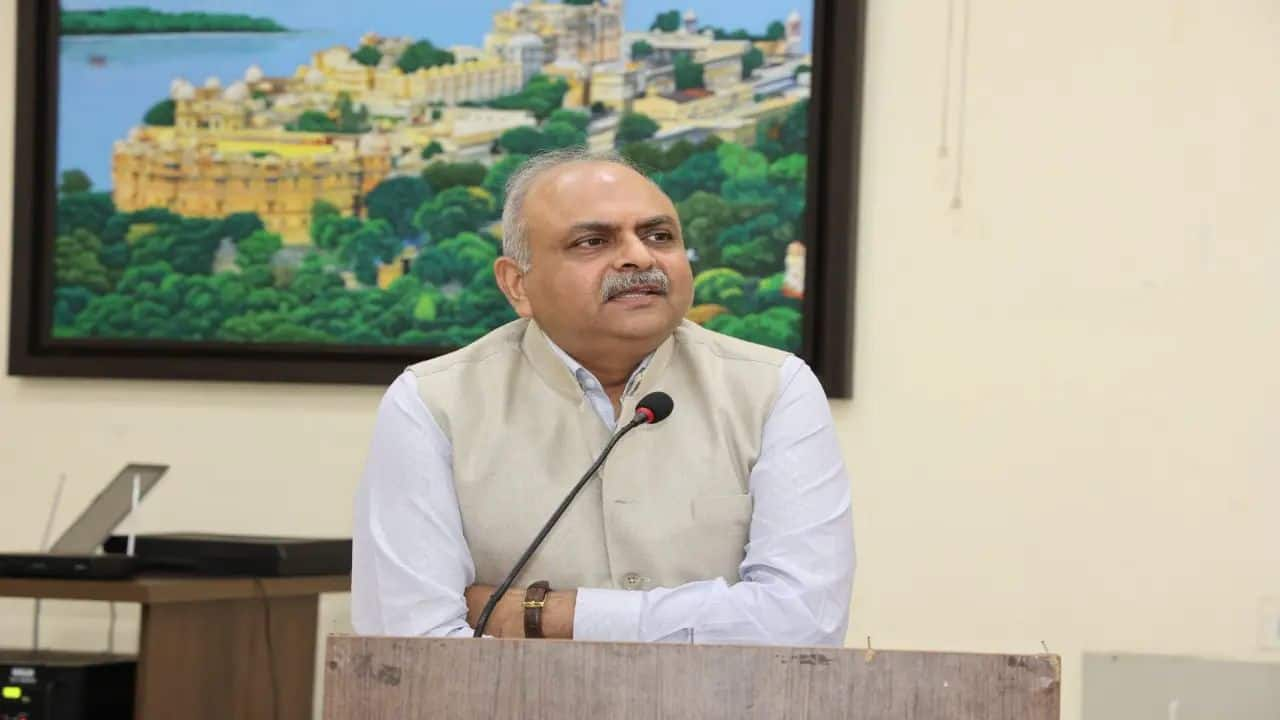

The federal government is making ready to simplify the Source of revenue Tax Act than earlier than. For this, a brand new model of this may also be presented within the subsequent 6 months. Ravi Aggarwal, chairman of the Central Board of Direct Taxes (CBDT), gave this knowledge in an unique dialog with Moneycontrol on Thursday 25 July. He stated, “The Source of revenue Tax Act will likely be simplified within the subsequent 6 months and it’ll be a brand new model of it.” After this, the entire procedures associated with source of revenue tax will likely be extra more uncomplicated than earlier than submitting ITR.

Ravi Aggarwal stated that greater than 66 p.c of the entire source of revenue tax returns (ITR) filed within the present monetary 12 months have selected new tax reset. A complete of 4 crore returns were filed to this point. He stated that the federal government’s focal point is at the ‘simplification’ of all processes to record ITR. Aggarwal stated, “The federal government believes that the extra you simplify, the extra it’ll be simple for the folks to practice the principles, which can building up it.”

The chairman of CBDT stated that there’s sufficient appeal some of the other people in regards to the new tax regime. About 66% of the ITRs filed so far are below the brand new Regime. It’s anticipated that later we can get extra advantages below the brand new tax regime.

Aggarwal stated that he’s additionally anticipated to lower litigation with simplifying the principles. He additionally stated that the evaluate will likely be finished throughout the subsequent three hundred and sixty five days after the hunt. He admitted that numerous huge collection of appeals and litigation within the case are caught within the case.

On the similar time, at the query of putting off indexation advantages from the sale of assets, Ravi Aggarwal stated that indexation on LTCG in actual property sector used to hide inflation best slightly. “Research means that 12.5 in line with cent LTCG dhar could also be extra advisable for buyers. The valuables costs have higher by way of 5 occasions within the remaining 10 years,” he stated.

Sanjay Aggarwal, Chairman of the Central Board of Exide and Customs (CBIC), was once additionally provide on this dialog with Ravi. Sanjay stated that steps were taken to advertise production within the price range. Elementary customized responsibility has been lowered on exporting industries associated with marine manufacturing.