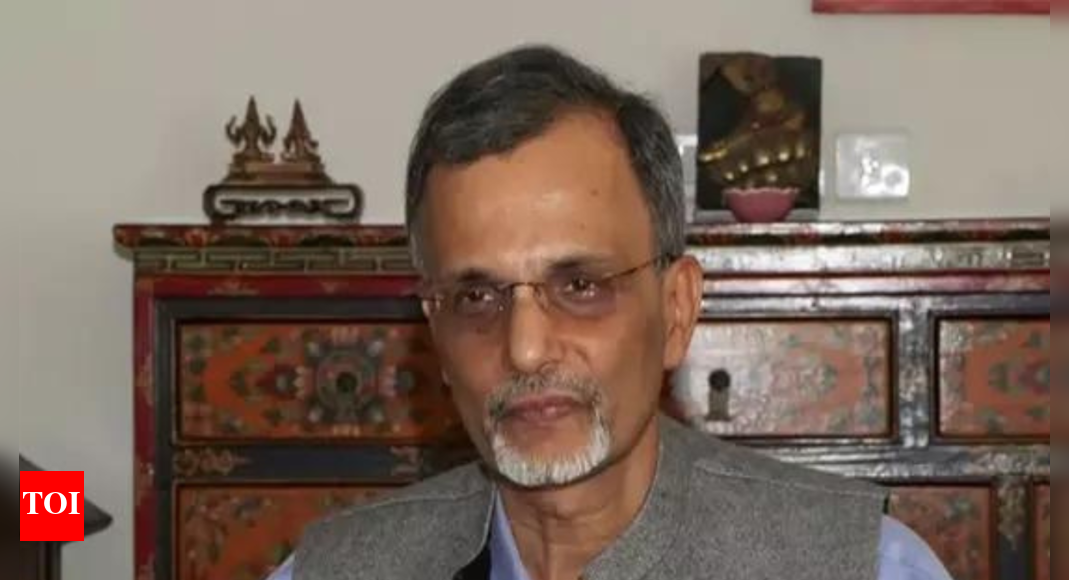

NEW DELHI: Leader Financial Consultant (CEA) V Anantha Nageswaran on Tuesday clarified that India isn’t taking part in any initiative to create an alternative choice to the United States buck, confirming that no such plans are into consideration. Talking at an AIMA match, he highlighted India’s financial resilience regardless of international business tensions and tariff disputes, as quoted by way of Financial Occasions. The CEA famous that mixed results of US price lists and up to date GST changes are anticipated to scale back FY26 GDP enlargement projections by way of 0.2–0.3 according to cent, conserving forecasts within the 6.3–6.8 according to cent vary.The rustic completed 7.8 according to cent actual GDP enlargement in Q1 FY26, pushed by way of larger financial job fairly than low inflation. Early signs from July and August recommend the sure momentum is constant into the second one quarter. Amongst G20 international locations, India will be the simplest economic system to take care of powerful enlargement persistently over the 4 years following the COVID-19 disruption.Reforms, Fiscal Self-discipline and Long term Center of attention Nageswaran attributed India’s financial balance to a decade of structural reforms integrating virtual and bodily infrastructure enhancements with formalisation of SMEs. Tasks such because the Insolvency and Chapter Code, GST, RERA, and public sector financial institution consolidation have progressed trade prerequisites, whilst contemporary GST and tax management reforms have simplified compliance. Highlighting global self assurance, he pointed to India’s sovereign credit standing improve to BBB from BBB-, the primary in just about two decades, which has decreased borrowing prices, with 10-year executive bond yields falling from 9 according to cent to six.4 according to cent. Stable power costs over the last 4 years have additionally helped comprise inflation. Fiscal self-discipline stays a concern, with the federal government on the right track to fulfill its 4.4 according to cent fiscal deficit goal for FY26. Taking a look forward, Nageswaran emphasized competitiveness, innovation, and productiveness as key enlargement drivers. He wired the will for cooperation between executive and the personal sector, urging companies to prioritise innovation over protectionism and supply significant alternatives for India’s younger body of workers in an an increasing number of virtual economic system.