Nifty Industry setup for July 7 : The Nifty 50 broke the 2 -day decline and recorded a zero.2 consistent with cent positive factors on 4 July. There used to be a purchase order close to the enhance degree of 25,300, which goes 78.6 consistent with cent with Fibonacci Retress (26,277 to 21,744). Regardless of the continued consolidation out there, Upper Prime and Upper Low Formation persevered. Marketplace mavens say that it’s imaginable to transport to twenty-five,700-25,800 so long as the Nifty stays at 25,300-25,200. Going above 26,000 will build up the Nifty additional. On the similar time, if the Nifty falls under 25,200, then 25,000 might fall.

Right here you’re giving some such figures at the foundation of which it is possible for you to to catch winning offers.

Fortify and resistance degree for nifty

Fortify according to Pivot Level: 25,368, 25,335 and 25,282

Resistance according to Pivot Level: 25,474, 25,507 and 25,559

Financial institution nifty

Resistance according to pivot issues: 57,083, 57,189 and 57,362

Fortify according to pivot issues: 56,738, 56,631 and 56,459

Resistance according to Fibonacci Retress: 57,566, 58,224

Fibonacci Retress primarily based enhance: 56,389, 59,096

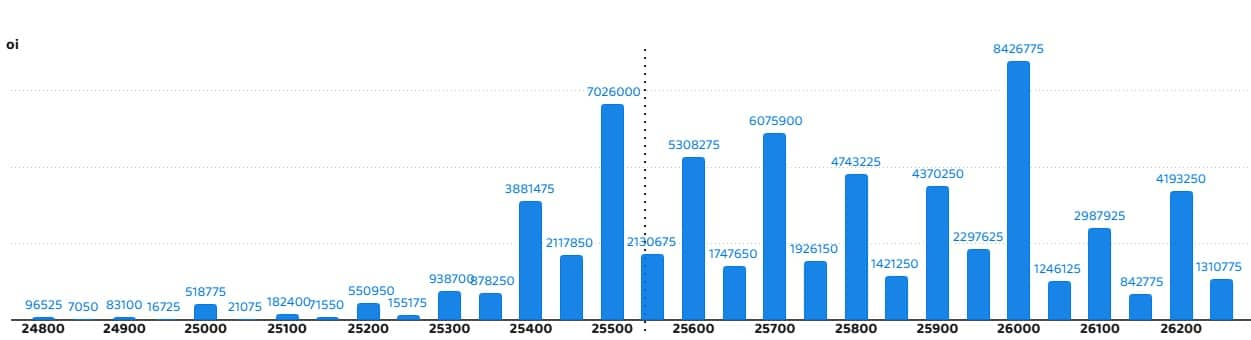

Nifty name choice information

A most name of 84.26 lakh contracts has been noticed open passion on a strike of 26,000 at the per 30 days foundation, which is able to paintings as the most important registration degree within the upcoming trade periods.

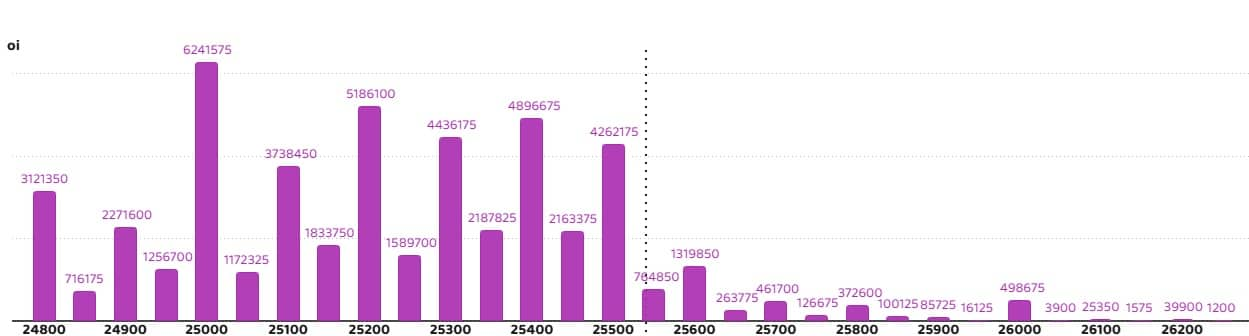

Nifty put choice information

A most of 62.41 lakh contracts were noticed open passion on a strike of 25,000, which is able to paintings as vital enhance degree within the coming trade periods.

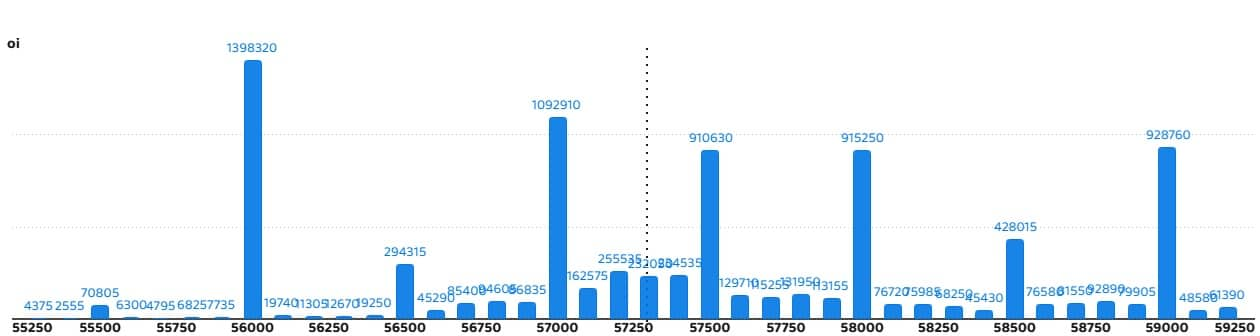

Financial institution Nifty Name Choice Knowledge

Financial institution Nifty has noticed a most name open passion of 13.98 lakh contracts on a strike of 56,000, which is able to paintings as the most important registration degree within the coming trade periods.

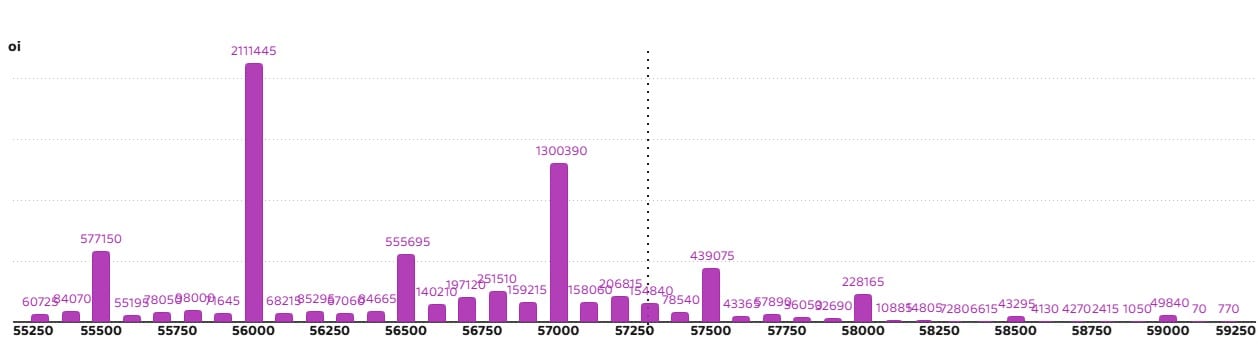

Financial institution Nifty put choice information

On a strike of 56,000, a most of 21.11 lakh contracts were noticed open passion, which is able to paintings as vital registration ranges within the coming trade periods.

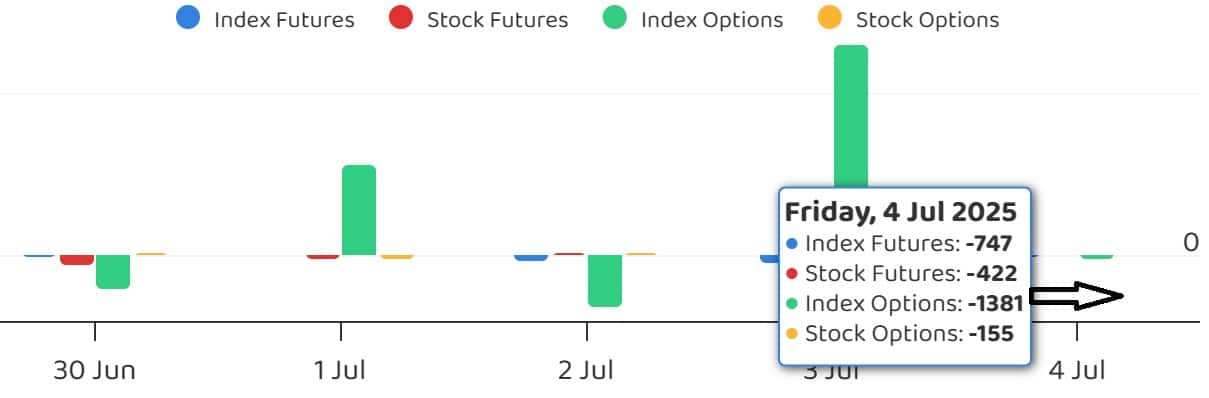

FII and DII Fund Waft

India VIX, which measured the volatility of the marketplace, reached a brand new low of 9 months with a decline within the fourth consecutive buying and selling consultation. It’s certain for Tejadis. It closed at 12.32, down 0.57 consistent with cent on July 4, the bottom degree since 1 October 2024.

Prime supply industry

Listed here are the shares given through which the biggest a part of the supply industry used to be noticed. The massive a part of supply displays the passion of traders (not like buying and selling) in inventory.

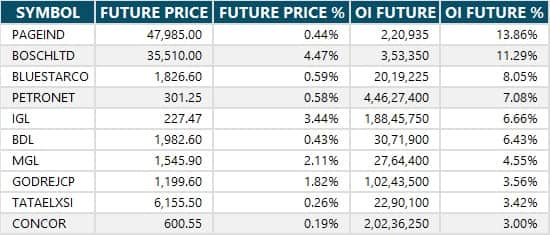

Lengthy build-ups proven in 61 shares

Along side the rise in open passion, the upward push in costs may be in most cases estimated to transform a protracted place. Lengthy build-ups had been noticed in 61 stocks at the earlier buying and selling day according to Open Pastime Long run Proportion.

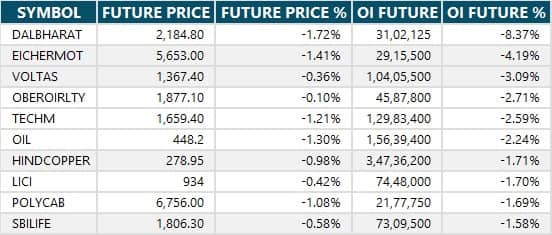

Lengthy Unwinding noticed in 43 Shares

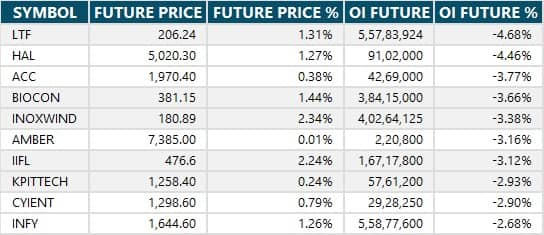

Along side the autumn in open passion, the autumn in costs may be in most cases gauged via lengthy confrontation. According to the Open Pastime Long run Proportion, the easiest lengthy lengthy lengthy lengthy -standing in 43 stocks used to be noticed at the earlier buying and selling day.

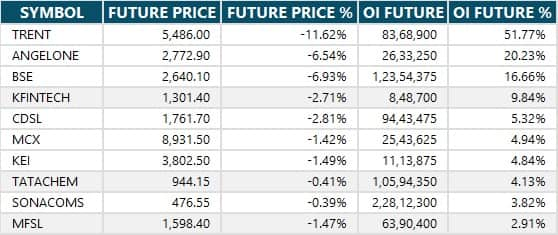

Brief build-up proven in 51 shares

Along side the rise in open passion, the decline in costs may be in most cases gauged via brief build-up. According to the Open Pastime Long run Proportion, the easiest brief build-up used to be noticed in 51 stocks at the earlier buying and selling day.

Brief protecting in 74 shares

Brief protecting is in most cases estimated via the upward push in open passion in addition to the upward push in costs. According to the Open Pastime Long run Proportion, 74 stocks noticed the easiest brief duvet in 74 stocks.

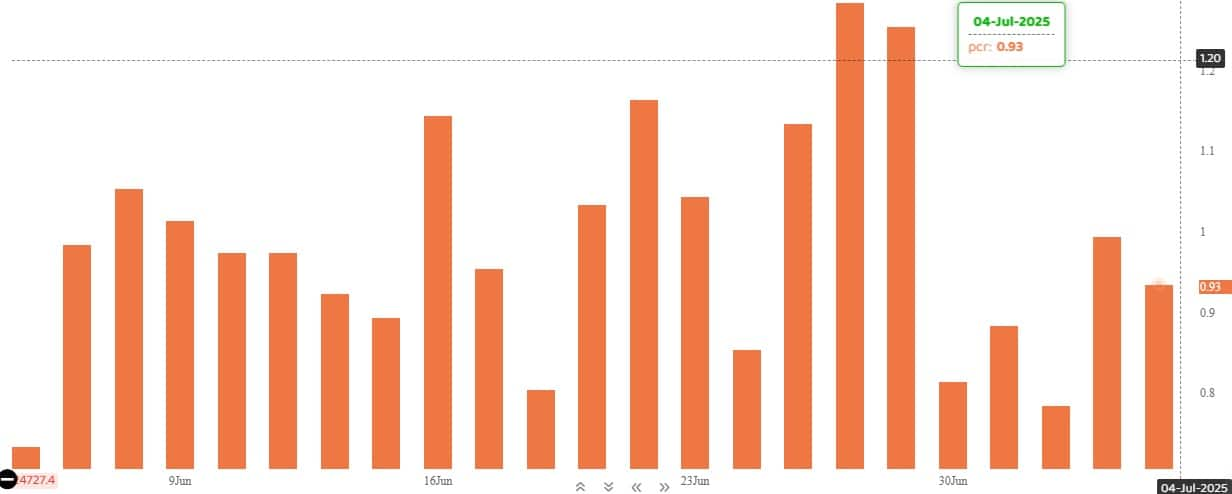

Name name ratio

The Nifty Put-Name Ratio, which depicted the marketplace temper, fell at 0.93 on July 4, whilst it used to be at 0.99 ranges within the earlier consultation. Considerably, the departure of PCR above 0.7 or 1 move PCR is in most cases regarded as an indication of increase. While the ratio falling under 0.7 or 0.5 is an indication of recession.

Inventory below F&O Bain

The F&O section comprises the limited securities that come with the spinoff contract marketplace broad place restrict to greater than 95 consistent with cent.

Shares enthusiastic about F&O ban: no one

Shares already enthusiastic about F&O ban: RBL Financial institution

Shares got rid of from F&O ban: no one

Disclaimer: The guidelines given on Moneycontrol.com have their very own private perspectives. The site or control isn’t accountable for this. Cash keep watch over advises customers to hunt the recommendation of qualified mavens earlier than taking any funding choice.