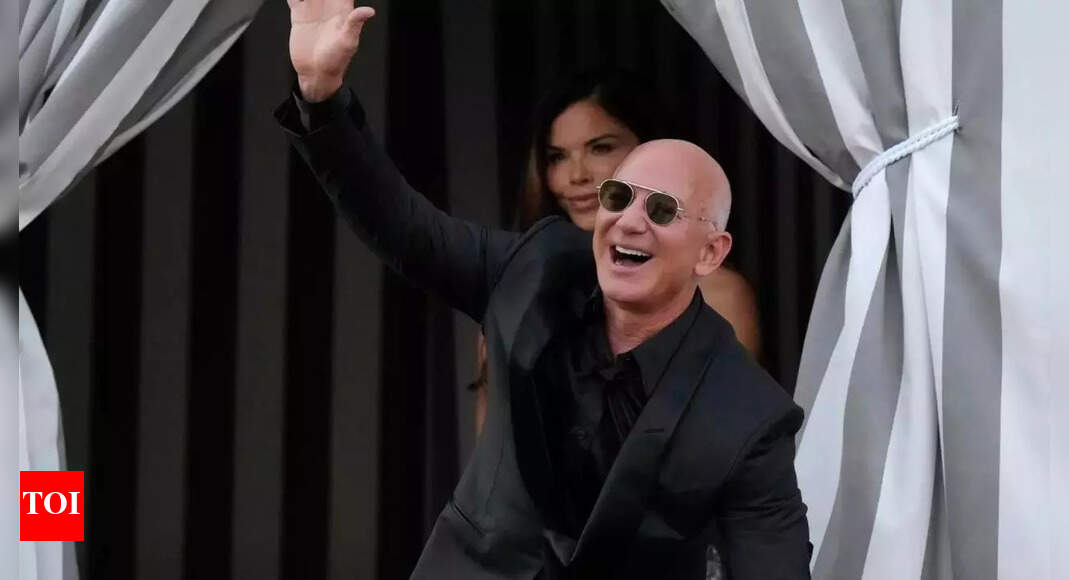

Amazon founder Jeff Bezos has offered every other 6.6 million stocks of the corporate, experiences Barrons. In keeping with the file, the sale used to be disclosed in a submitting with Securities and Change Fee (SEC). The offered stocks are valued round $1.5 billion. The transaction, as according to the file, happened on July 21 and 22 – days forward of Amazon’s second-quarter profits scheduled for July 31. The sale used to be done underneath the prearranged buying and selling plan referred to as Rule 10b5-1.

What’s 10b5-1 buying and selling plan underneath which Amazon founder Jeff Bezos offered stocks

Rule 10b5-1 is a legislation from america SEC that we could insiders at public corporations arrange a plan to promote their stocks forward of time. Below this rule, main shareholders can agenda the sale of a hard and fast collection of stocks at a collection time, serving to them steer clear of accusations of insider buying and selling. Many corporate executives use 10b5-1 plans because of this. The guideline used to be presented to explain Rule 10b-5, a part of the Securities Change Act of 1934, which is the primary regulation used to research securities fraud.

Jeff Bezos plans to promote extra Amazon stocks

As according to Barrons file, the Amazon founder plans to promote extra stocks one day. ‘Bezos isn’t completed,’ the file says.Amazon founder Jeff Bezos has been on a inventory promoting spree just lately. Previous this month, he offloaded roughly $737 million value of Amazon inventory. He has offered round $4.8 billion value of the corporate’s shares over the last two years. Jeff Bezos nonetheless holds 4.6 million stocks of Amazon, valued at $1 billion. As published in a regulatory submitting, the previous CEO plans to promote as much as 25 million stocks during the buying and selling plan “supposed to meet Rule 10b5-1(c)” that ends on Would possibly 29, 2026.Just lately, Nvidia CEO Jensen Huang additionally offered his stocks.