The Donald Trump management’s attainable transfer to impose a tax on jobs outsourced out of doors the USA have despatched jitters within the Indian IT sector. The possible advent of law by means of a Republican senator to impose taxes on IT services and products outsourcing in america poses important dangers to Indian era companies, doubtlessly undermining their aggressive pricing benefit and affecting their trade operations.This buzz follows a up to date social media put up shared by means of Peter Navarro, the USA President’s senior counsellor for business and production, suggesting price lists on all outsourcing and overseas far flung staff. The timing is especially difficult because the business faces present pricing pressures and lowered deal task because of wary tech spending and synthetic intelligence disruption.The “Halting Global Relocation of Employment Act” (HIRE Act), put ahead by means of Republican Senator Bernie Moreno in the USA Senate on Saturday, proposes a 25% tax on US firms that outsource employment out of the country. This remarkable center of attention at the services and products sector in US business discussions has stuck Indian IT companies unprepared.

How will Trump admin’s HIRE Act hurt Indian IT sector?

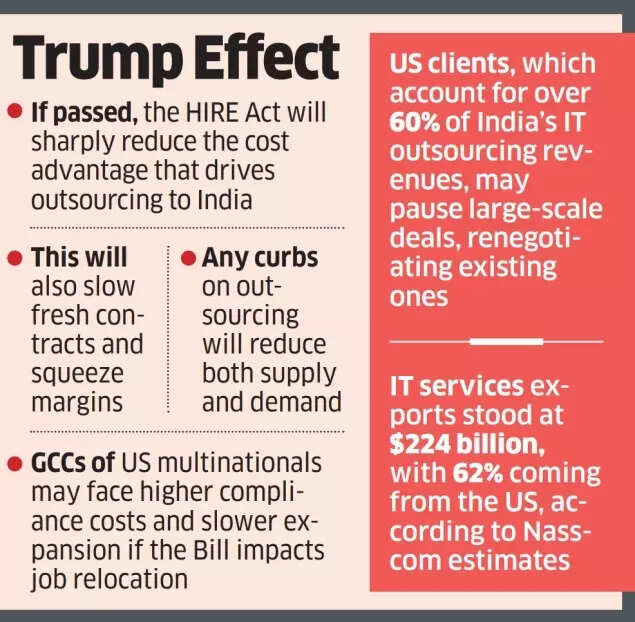

Business professionals warning that the passage of this Invoice may just result in additional spending discounts by means of US purchasers, who recently generate greater than 60% of India’s IT outsourcing source of revenue.

Trump impact

“The proposed HIRE Act would considerably diminish the monetary advantages of outsourcing to India,” defined Rohit Jain, managing spouse at legislation company Singhania & Co. “This would affect new contract acquisitions, have an effect on benefit margins, and compel Indian IT firms to hunt enlargement alternatives in markets past america,” he advised ET.Additionally Learn | Trump price lists on India’s instrument exports? Why IT sector is anxious – double taxation, visa tightening might deal a blowJain indicated that many US purchasers would possibly droop main agreements, search contract adjustments, or relocate operations locally to mitigate policy-related dangers. “Some would possibly handle relationships with Indian suppliers while looking for extra beneficial phrases, given the providers’ difficult place,” he famous. “Price pressures might build up, specifically for fundamental IT services and products akin to software construction and upkeep, even supposing complicated virtual transformation and AI tasks would possibly stay much less affected.“IT organisations are increasing their presence throughout Asia, Japan, Australia, Nordic international locations and the Heart East to safe new shoppers, while keeping up important dependence on US markets.“When combining excise tax, federal company tax and state-specific taxes, the overall price build up for offshore services and products may just succeed in as much as 60%,” mentioned Nitin Bhatt, era sector chief, EY India.“Many purchasers might ask their IT carrier suppliers to soak up the tax affect by means of providing tax-inclusive pricing or lowering charges,” he stated, noting that organisations would possibly build up their native recruitment in the USA while lowering visa-dependent groups.“Not like previous downturns pushed by means of financial cycles, this disaster is man-made, with repercussions now not just for Indian IT suppliers but additionally for US purchasers already grappling with emerging prices from price lists and visa restrictions,” stated Saurabh Gupta, president at analysis and advisory services and products company HfS Analysis in line with the ET file.Additionally Learn | Hyundai raid fallout, US paintings visa machine hurdles: How Trump’s Made-in-US dream is being paralysed – definedHe additional mentioned that restrictions on outsourcing would have an effect on each provide and insist, leading to dearer and not more dependable carrier supply.SBICaps analysis signifies that the USA stays India’s number one export vacation spot, comprising 17.7% of general exports in FY24. India maintains a business surplus of $45.7 billion with the USA. This contains $38 billion in items business, with services and products (essentially IT and instrument) accounting for the remaining.In keeping with Nasscom estimates, IT services and products, together with {hardware}, generate $224 billion in export income, with 62% originating from the USA marketplace.Arun Prabhu, spouse (head – era) at legislation company Cyril Amarchand Mangaldas, stated the Invoice, as drafted, may just make outsourcing “considerably dearer” for US entities.“It is recently very unclear on what the general language of the Invoice will seem like. Whilst a partisan proposal might appear sexy, it is very unclear how some forms of task akin to construction of highbrow assets like {hardware} and instrument which is offered or utilized in world markets (together with the USA) shall be handled,” he added.The results may just considerably have an effect on world capacity centres (GCCs), which serve as as technological hubs for main US multinational firms and era firms with considerable Indian operations. Those organisations handle a substantial personnel presence in India.Jain of Singhania & Co. famous that while GCCs don’t utilise vendor-client billing constructions, any complete tax machine that imposes consequences on task relocation would possibly build up regulatory bills and slow down enlargement methods.