Nifty Business setup for July 18 : The Nifty broke the 2 -day lead the day past and on July 17, the Weekly F&O expiry consultation ended with a decline of 0.4 in step with cent. Given the technical signs, the full Nifty 50 remains to be buying and selling sideways with destructive tendencies and is looking forward to a cause to catch a blank course. Consolidation can proceed till it’s decisively closed above the 20-day EMA (about 25,250). For this, quick fortify is visual on the degree of 25,000 after which 24,900. Marketplace mavens say that the quick resistance is at 25,350 (higher zone of the July 11 bearish hole) when leaving from 25,250, because the Nifty can transfer in opposition to the extent of 25,550 and 25,700 if it stays above.

Right here you might be giving some such figures at the foundation of which it is possible for you to to catch successful offers.

Fortify and resistance degree for nifty

Fortify in keeping with Pivot Level: 25,098, 25,065, and 25,013

Resistance in keeping with Pivot Level: 25,203, 25,235, and 25,288

Financial institution nifty

Resistance in keeping with pivot issues: 57,142, 57,256 and 57,440

Fortify in keeping with pivot issues: 56,773, 56,659 and 56,474

Resistance in keeping with Fibonacci Retress: 57,050, 57,566

Fibonacci Retresh’s fortify: 56,681, 56,389

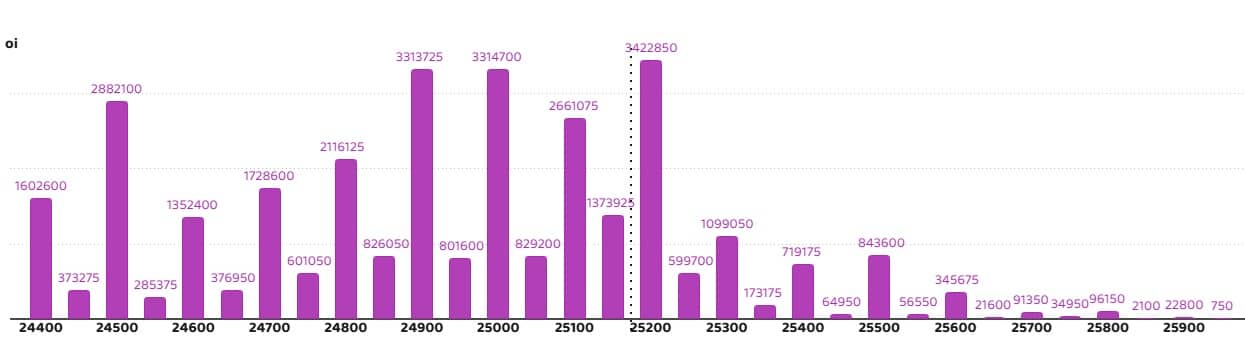

Nifty name possibility knowledge

A most name of 56.08 lakh contracts has been noticed open hobby on a strike of 25,200 on Per 30 days Base, which can paintings as essential registration ranges within the coming trade classes.

Nifty put possibility knowledge

On a strike of 25,200, a most put of 34.22 lakh contracts has been noticed open hobby which can paintings as essential fortify degree within the coming trade classes.

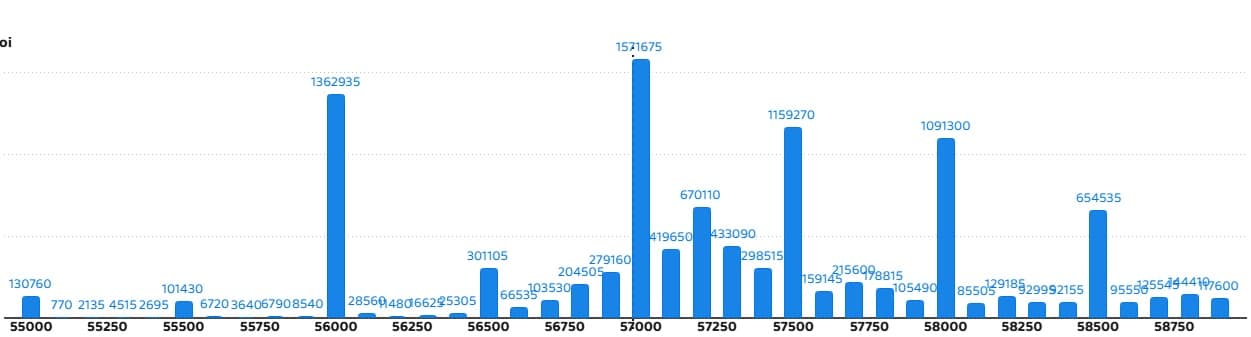

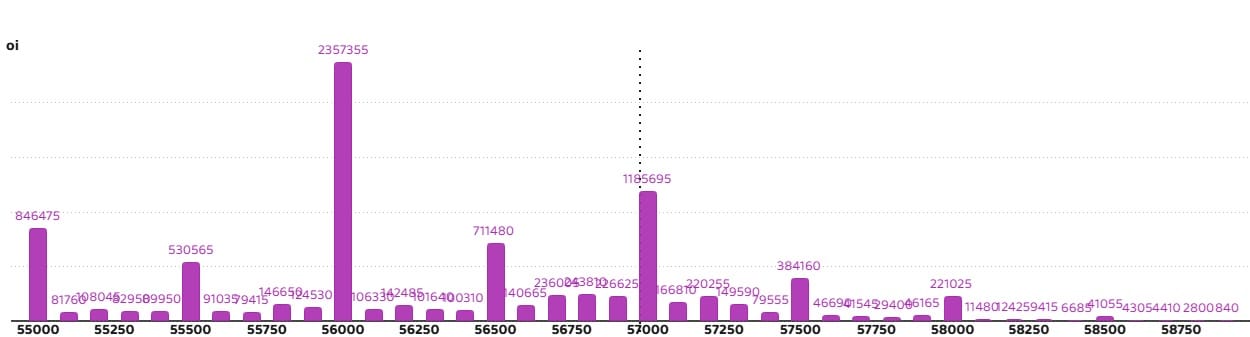

Financial institution Nifty Name Choice Information

The financial institution Nifty has noticed a most name open hobby of 15.71 lakh contracts on a strike of 57,000, which can paintings as crucial registration degree within the upcoming trade classes.

Financial institution Nifty put possibility knowledge

On a strike of 56,000, a most of 23.57 lakh contracts were noticed open hobby, which can paintings as crucial registration degree within the coming trade classes.

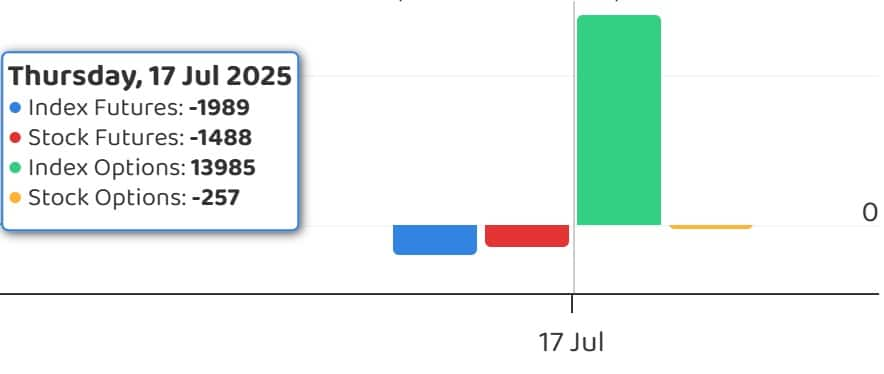

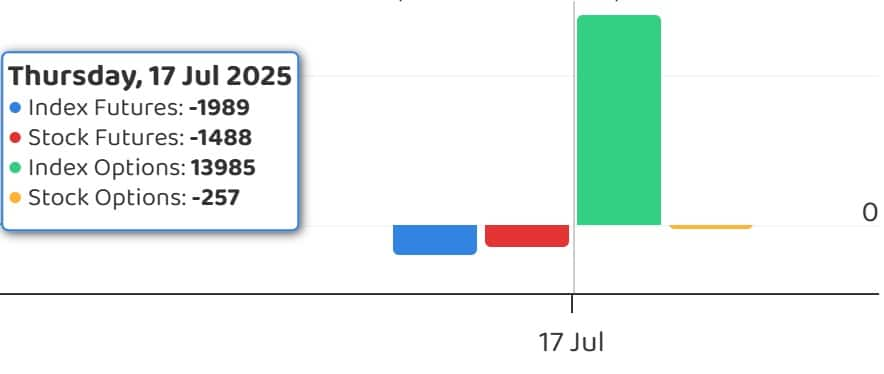

FII and DII Fund Waft

India Vix, which measured possible fluctuations available in the market, rose 0.02 % to 11.24 the day past after the autumn of the ultimate two classes. Then again, it remained under 12 issues. This can be a signal of marketplace fluctuations reducing. However buyers will have to be vigilant about any sharp decline or decline available in the market.

Top supply business

Listed below are the shares given through which the biggest a part of the supply business used to be noticed. The massive a part of supply displays the hobby of traders (not like buying and selling) in inventory.

Lengthy build-up proven in 40 shares

At the side of the rise in open hobby, the upward push in costs could also be typically estimated to grow to be an extended place. Lengthy build-ups have been noticed in 40 stocks at the earlier buying and selling day in keeping with Open Hobby Long run Share.

Lengthy Unwinding noticed in 51 Shares

At the side of the autumn in open hobby, the autumn in costs could also be typically gauged via lengthy confrontation. In keeping with the Open Hobby Long run Share, the best lengthy lengthy lengthy lengthy -liveding of 51 stocks used to be noticed at the earlier buying and selling day.

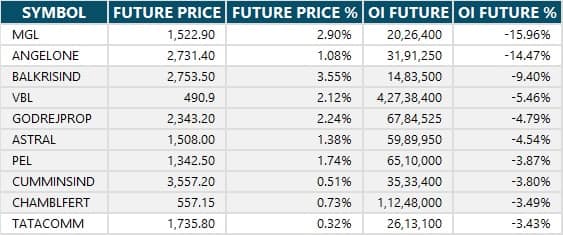

Brief build-up proven in 71 shares

At the side of the rise in open hobby, the decline in costs could also be typically gauged via quick build-up. In keeping with the Open Hobby Long run Share, 71 stocks have been noticed to have the best quick build-up.

Brief overlaying in 67 shares

Brief overlaying is typically estimated via the upward push in open hobby in addition to the upward push in costs. In keeping with the Open Hobby Long run Share, the best quick duvet used to be noticed in 67 stocks at the earlier buying and selling day.

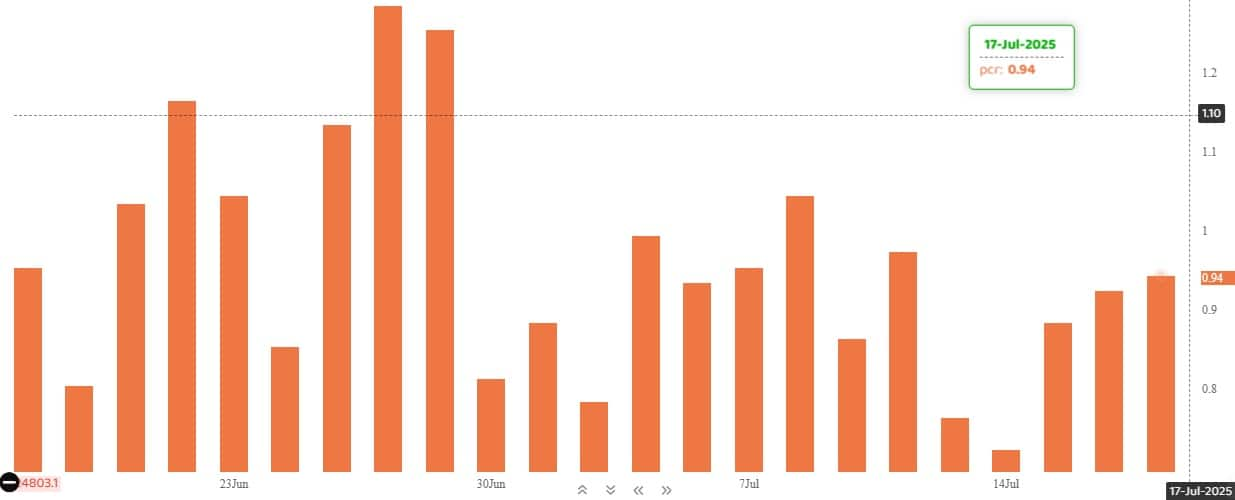

Name name ratio

The Nifty Put-Name Ratio, which depicted the marketplace temper, rose to 0.94 on July 17, in comparison to 0.0.92 within the earlier consultation. Considerably, the departure of PCR above 0.7 or 1 go PCR is normally thought to be an indication of growth. While the ratio falling under 0.7 or 0.5 is an indication of recession.

Inventory below F&O Bain

The F&O section contains the limited securities that come with the spinoff contract marketplace extensive place restrict to greater than 95 in step with cent.

Inventory thinking about F&O ban: RBL Financial institution

Inventory already thinking about F&O ban: Angel One, Hindustan Copper

Inventory got rid of from F&O ban: no person

Disclaimer: The information given on Moneycontrol.com have their very own non-public perspectives. The website online or control isn’t chargeable for this. Cash keep an eye on advises customers to hunt the recommendation of qualified mavens sooner than taking any funding resolution.