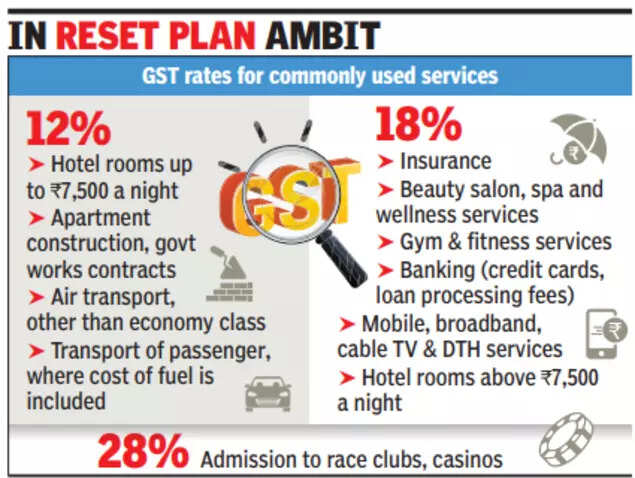

NEW DELHI: As Workforce GST – comprising state ministers and finance secretaries – descends at the Capital for an important conferences beginning Tuesday, all eyes are on how the omnipotent frame offers with products and services within the 12% and 28% slab, in addition to some within the 18% bracket.Services and products similar to resort rooms that value as much as Rs 7,500 an evening are within the 12% bracket whilst those above the brink are within the 18% phase. For the reason that the Centre – which has floated the revamp and simplification plan – is eager to finish classification issues, it continues to be noticed how the products and services are treated. Identical is the case with some others similar to air go back and forth, the place financial system magnificence and industry magnificence are in numerous slabs.Given the earnings implications, one of the switches don’t seem to be simple. For example, there’s reputation that the levies on one of the banking products and services at 18% is prime nevertheless it might not be possible to modify it instantly.

On the subject of insurance coverage, alternatively, the adjustments within the charges for time period and well being covers will, alternatively, lead to two other charges. So, you are going to proceed to pay 18% for insuring your automobile or for a householder’s coverage.There are calls for to ease the charges on one of the not unusual use products and services. For example, repairs fees for residences face an 18% levy in case the fee exceeds Rs 7,500 a month, even though it’s to the RWA or the condo house owners’ affiliation. Condo house owners have argued that during maximum condominiums the upkeep fees most sensible the extent even for three-bedroom homes.There are others too, however the point of interest of the present workout seems extra on fine-tuning issues at the items facet, even though products and services similar to salon might see tweaks.Some products and services like the ones associated with access into casinos are anticipated to transport to the 40% slab for sin and comfort items.Whilst the GST Council meets on Sept 3 and four, the fitment committee, comprising of officers from states, will talk about the main points on Tuesday.Excluding decreasing the weight at the not unusual guy, the theory is to simplify the regime via eliminating the 12% and 28% slabs with 99% of the previous slab’s pieces prone to transfer into the 5% phase.