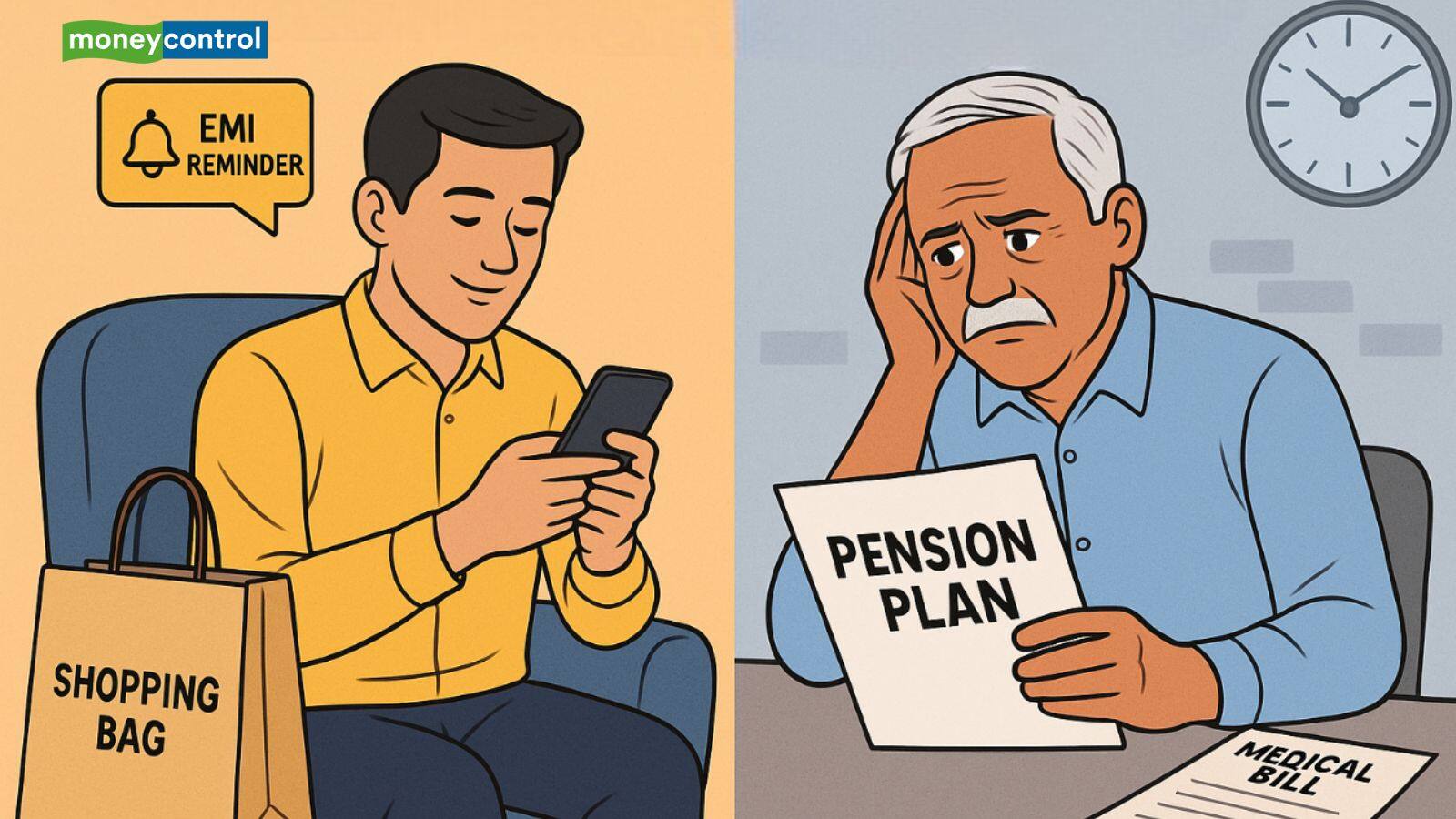

Retirement Making plans: Lately, the hand of the adolescence is coming to the cash. Simple funding choices also are to be had. Alternatively, a lot of Indian adolescence are nonetheless suspending retirement making plans. The top wealth finserv co-founder and govt director Chakravarthy V (Chakravarthy V) and Chakravardhan Kuppala say that this negligence can result in primary monetary issues later.

Chakraborty says, “For those who retire on the age of 60 and reside until 85, then you must spend 25 years with out wage. The query isn’t what number of years you’re going to reside, however it’s what number of years your cash will remaining.”

Expanding age and bills

In line with each professionals, other folks prioritize retirement to house, youngsters’s training or different bills first, taking into consideration retirement as a far off function. However existence expectancy is expanding in city India and conventional make stronger methods like joint circle of relatives are now not dependable.

Additionally, healthcare bills additionally building up sooner than commonplace inflation and this expenditure is at its top when your common source of revenue stops. In one of these state of affairs, you will need to for many who wouldn’t have any formal pension, it turns into essential to make a powerful fund for retirement.

How much cash will likely be sufficient?

Chakravarti and Kuppala suggest that on the age of 30 other folks suppose what existence is wanted after retirement. As an example, if the per thirty days expenditure of your own home lately is ₹ 60,000, then if 6–7% annual inflation is fed on, then the similar expenditure can succeed in ₹ 1.5–2 lakhs in 25 years.

In one of these state of affairs, a retirement fund of no less than ₹ 4 to ₹ 6 crore will also be important, in order that 20–25 years will also be taken out very easily. For this, the fund hole must be estimated by way of reviewing the present funding like EPF, PPF, Mutual Fund and Actual Property.

They are saying that by way of beginning with a SIP of ₹ 15,000–20,000, the important budget will also be ready by way of step by step expanding it. Additionally, it will be significant to devise how the cash will likely be withdrawn after retirement.

What are the choices to be had?

There are lots of choices for getting ready retirement budget in India. Professional says that you’ll make investments cash in any of them in keeping with your comfort. Or you’ll divide a part of the funding into all excellent schemes.

PPF (Public Provident Fund): Secure choices with govt ensure and tax loose returns, particularly for Conservative Traders.

EPF (Staff Provident Fund): The manner of widespread financial savings for wage, together with the contribution of the employer.

NPS (Nationwide Pension Gadget): A protracted -term plan with low price, versatile asset allocation and tax receive advantages.

Fairness mutual budget via SIP: Lengthy -term easiest expansion possibility, which is now taking part in the most important position in retirement making plans.

SIP has turn into a brand new addiction

Chakravardhan Kuppala says that now persons are adopting SIP as a per thirty days dedication, akin to hire or EMI. In March 2025, a internet influx of greater than ₹ 7,000 crore used to be observed in mid-cap and small-cap mutual budget, which is smart that regardless of the volatility of those segments, other folks trust in India’s long run expansion. Dedication to SIP could make other folks make excellent cash in long run.

Additionally learn: 69 lakh or 17 lakh rupees? Don’t move to quantity, this cash may be much less for the way forward for the kid, know the place to speculate proper

Disclaimer: Recommendation or concept professionals/brokerage corporations given on Moneycontrol.com have their very own non-public perspectives. The website online or control isn’t liable for this. Moneycontrol advises to customers that all the time search the recommendation of qualified professionals sooner than taking any funding resolution.